Web Application Firewall Market Forecast, Competitive Landscape | 2035

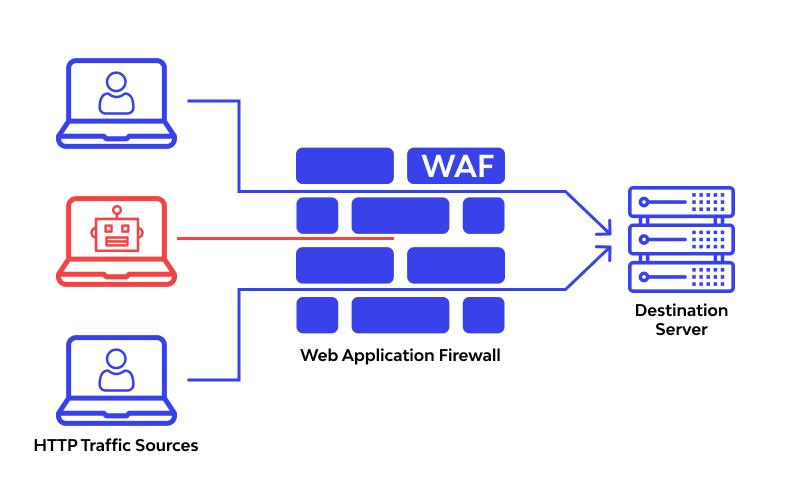

A detailed Web Application Firewall Market Share Analysis reveals a highly competitive and multifaceted market, where different categories of players, from global cloud and network giants to specialized cybersecurity pure-plays, all compete for a share of the critical application security budget. A significant and rapidly growing portion of the market share, particularly in the cloud-based WAF segment, is held by the major Content Delivery Network (CDN) and public cloud providers. Companies like Akamai, Cloudflare, and the major hyperscalers (Amazon Web Services, Microsoft Azure, and Google Cloud) command a substantial share. Their competitive strategy is to offer a WAF as a seamlessly integrated feature of their broader edge computing, cloud delivery, and cloud infrastructure platforms. Their advantage lies in their massive global scale, their ability to absorb huge DDoS attacks, and the convenience of offering a "one-stop-shop" for both application performance and security. For the millions of businesses already using their CDN or cloud services, adding the WAF is often the path of least resistance. The Web Application Firewall Market is expected to reach USD 20 billion by 2035, growing at a CAGR of 10.58% during the forecast period 2025-2035. The intense competition among these edge and cloud giants to offer the most powerful and easy-to-use integrated security features is a key feature of the landscape.

Despite the strong position of these large platform players, a very significant portion of the market share is held by a vibrant ecosystem of "pure-play" application security and traditional network security vendors. This category includes dedicated WAF specialists like Imperva and F5 Networks (who also have a strong presence in the hardware appliance market), as well as a host of other innovative cybersecurity firms. These companies compete not on the breadth of their cloud portfolio, but on the depth and sophistication of their security capabilities. Their market share is built on their long history of innovation in application security, their advanced AI-powered threat detection engines, and their ability to provide more granular policy controls and deeper security insights than the more generalist offerings from the cloud providers. They often win deals with organizations in highly regulated or security-conscious industries (like finance and government) who are seeking a best-of-breed, defense-in-depth security solution rather than the "good enough" security that might be bundled with their CDN or cloud service.

Looking to the future, the distribution of market share will be increasingly influenced by a provider's ability to offer a comprehensive and integrated "Web Application and API Protection" (WAAP) platform. The competitive landscape is moving beyond the core WAF. The battle for market leadership will be fought on the strength of a vendor's capabilities in the three other key pillars of WAAP: DDoS mitigation, bot management, and, most importantly, API security. As modern applications become more reliant on APIs, the ability to automatically discover all of an organization's APIs, enforce security policies against them, and detect anomalous API traffic is becoming a critical competitive differentiator. The vendors who can offer the most complete and seamlessly integrated WAAP platform, providing a single policy engine and a unified view of threats across all of these different vectors, will be best positioned to gain share. The future of the competitive landscape will belong to those who can master the complexity of protecting the entire modern application ecosystem.

Top Trending Reports -

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness